A Beginner's Guide to Trading with SASA Markets:

Basics Of Commodities Trading

The world of finance is enormous and constantly evolving. It offers a great number of opportunities for keen investors. Have you ever considered the dynamos that run our global economy – the raw materials themselves? Here is where commodities trading enters the scene.

Commodities trading is a dynamic marketplace. This marketplace allows you to trade anything from the oil of your car to the coffee beans you use to brew.

Navigating through the complexities of commodities trading may be frightening for inexperienced entrepreneurs. But fear not, aspiring traders!

Let’s dive deep into this comprehensive guide about commodities trading, presented by SASA Markets, a licensed and regulated broker under the CMA of Montenegro. Thus you will have the knowledge and confidence to explore the exciting world of commodities trading.

What Are Commodities?

The Basics of Commodities Trading!

Commodities are essential goods that shape both global industries and daily life. They are a very important part of trade systems. Commodities can be categorised into two main groups:

Hard Commodities: These are generally natural resources. Hard commodities typically include precious metals like gold and silver, industrial metals such as aluminium, and energy sources like natural gas and oil.

Soft Commodities: These are agricultural goods that we grow or raise, like wheat, sugar, corn, and cotton.

Why Trade Commodities? Diversification and Beyond

While the stock market focuses on the fortunes of individual companies, commodities offer a unique way to diversify your portfolio and potentially capitalise on much broader economic trends. Here are reasons why commodities trading may be a good option you:

Tangible Assets

Commodities are real, physical goods, not abstract financial instruments. This can offer a sense of security.

Shield Against Inflation

Commodities are often appreciated during inflationary periods. This could potentially safeguard your purchasing power and fortify your investment collection.

Global Market

The commodities market is worldwide. It allows you to take advantage of international trends affecting supply and demand.

High Liquidity

Major commodities are highly liquid. Thus you can quickly enter or exit positions and respond to real-time market changes.

How Commodity Trading Works?

Contracts and Speculation

Trading commodities is about dealing with contracts for a specific amount of a commodity to be delivered in the future, instead of buying actual goods like a bag of coffee beans. Here’s how commodity trading works:

Contracts:

Contracts are traded on designated exchanges. They outline the type of commodity, the quantity, delivery date, and price.

Buying vs. Selling:

Traders guess if prices will go up or down. If they think prices will go up, they buy contracts. If they think prices will go down, they sell contracts. This could be explained by going long or short as well. Traders can speculate on prices by buying contracts (going long) in case they believe the price will rise, or by selling contracts (going short) if they expect a decline in prices.

Settlement:

There are two ways to settle a contract: Delivering the goods (which is quite rare) or cancelling out the contract with a counteracting deal before expiry date.

Key Elements of Commodities Trading

Commodities trading requires you to have an in-depth understanding of the factors which directly influence the prices. Here are some key elements of commodities trading:

Supply and Demand:

Basic economic principles matter. For example, events such as droughts that affect farm outputs or disruptions in oil production can greatly change prices.

Global Economy:

Trade conflicts, currency changes, global events and economic growth in various regions may affect prices.

Inventory Levels:

In commodity trading, the reserves of goods critically impact price stability or volatility. Perception plays a key role; perceived scarcity can lead to price instability, while perceived abundance may stabilise or lower prices. Thus, the balance of supply significantly influences market prices.

Weather Patterns:

Agricultural goods are quite sensitive to weather conditions. Floods, droughts or heat waves can affect yield and prices.

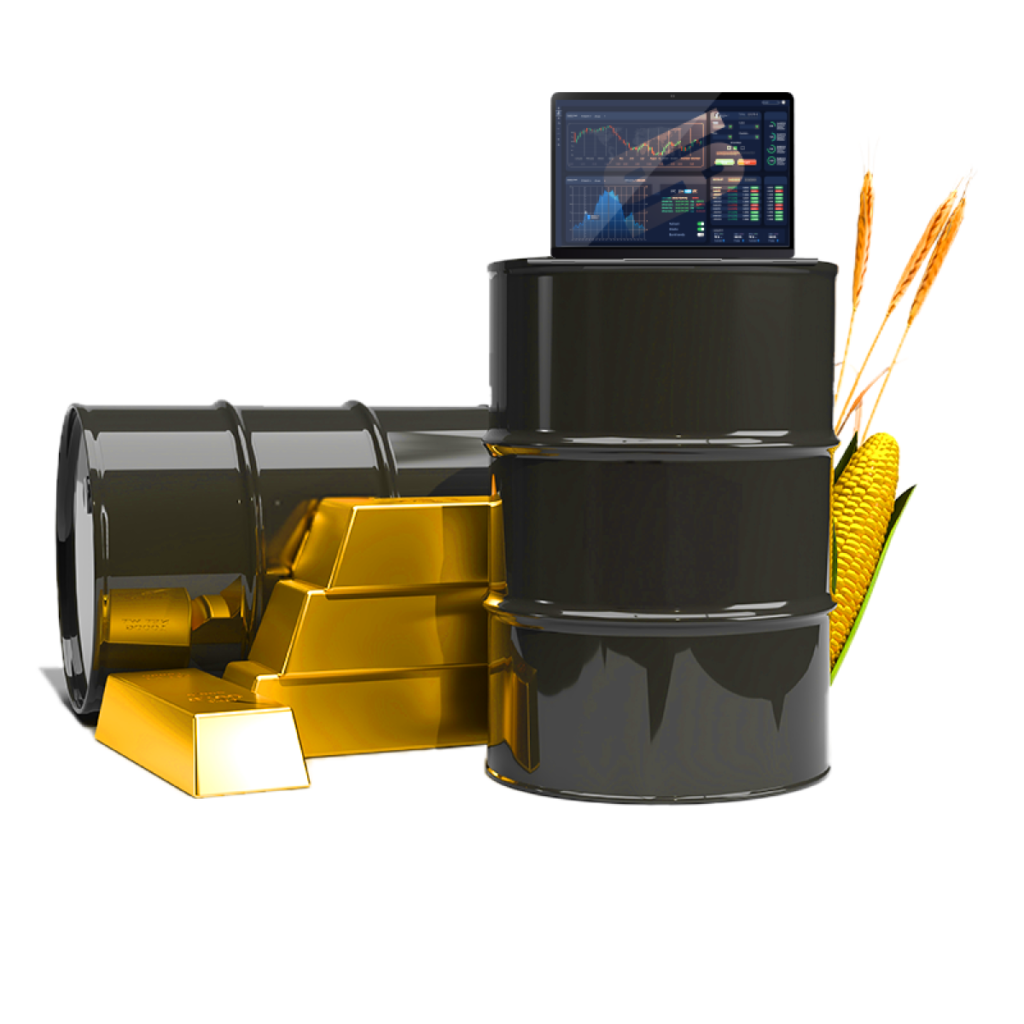

Commodities Trading With A Powerful Tool, Regulated with Caution

(SASA Markets Offers 1:100 Leverage)

Leverage is a well-known financial tool that allows you to control a larger position in a commodity than your actual capital. For example, SASA Markets offers 1:100 leverage. This means a $1,000 deposit would allow you to control a $100,000 position. This has the ability to increase both your profit and losses. Here’s why using leverage requires caution:

Increased Losses:

Leverage has the ability to increase profits, but it can also magnify losses if the market moves against you.

Margin Calls:

If your account value falls below a certain threshold due to losses, you may receive a margin call from your broker. This requires you to deposit additional funds or face liquidation of your position.

Risk Management Essential:

Leverage should only be used by experienced traders. It requires a sound risk management strategy.

Why Choose SASA Markets for

Your Commodities Trading Journey?

SASA Markets enable you to navigate the commodity market swiftly and safely. Here you can find our strengths:

Licenced and Regulated:

Our dedication to security and openness is crucial. Our CMA of Montenegro licence guarantees that we abide by the strictest regulations.

Advanced Trading Platform:

SASA’s intuitive platform offers advanced charting tools, integrated educational resources and real-time market data. These intend to improve your trading experience.

Dedicated Customer Support:

We welcome your questions and concerns 7/24. Our friendly support team is here to help you around-the-clock.

Competitive Spreads and Low Commission Rates:

Take advantage of competitive pricing strategies which let you retain a larger portion of your earnings.